Our Answer To Why Turks and Caicos?

For foreign investors, a number of criteria could be used to decide where to invest in the Caribbean. For many potential investors, the following factors would be considered:

- English language speaking

- U.S. Dollar (instead of a volatile local currency)

- No or minimal exchange restrictions and currency controls

- Ability of non-citizens to own land and homes

- Lack of a payroll, income, and property taxes

- Low or no sales tax or VAT

- Good international connections (flights)

Of all the Caribbean island nations (including the northern-Atlantic countries of the Bahamas, Bermuda, and Turks and Caicos), there are only two countries that meet the criteria above: the Turks and Caicos Islands and the Cayman Islands.

Direct Country Comparisons

Bermuda is notable for (a) payroll tax, (b) property tax, (c) restrictions on foreign land ownership, (d) a low number of international flight connections, (e) restrictions on car ownership, and a number of other freedom-impacting local laws. Furthermore, the population density is nearly 16 times that of the Turks and Caicos (3,302 persons per square mile compared to 202 in TCI). In addition, there are restrictions on land ownership (for example, holders of PRCs can’t purchase vacant land), and the minimum annual rental requirement for foreigners is $126,000 for a house (less for condo units).

The Bahamas, geographically part of the same archipelago as the Turks and Caicos, became independent in 1973. It since has developed its own currency (the Bahamian Dollar) and imposes both exchange and capital controls on persons taking capital out of the country. For example, individuals spending more than $15,000 in U.S. dollar travel expenditures requires central bank approval. The Bahamas also has a property tax, VAT (10%), and high unemployment (10.06% in 2022).

Barbados has a high income tax (33.5% of income over $17,353 USD, 2023 data), VAT (17.5%), property tax, and a relatively low GDP per capita of $17,225.46 USD (2021 data). The country is also extremely dense from a population standpoint at 1,709 persons per square mile (compared to 207 people per square mile in the Turks and Caicos).

The British Virgin Islands has limited international flight connections (9 international cities as of 2019) and restrictions on foreign land ownership. In addition, there is a multi-tiered level of citizenship and status system whereby persons born outside of the islands may not obtain full status within the country. The purchase of land by foreigners is restricted, and requires approval from the Governor, and notice of intent to purchase in local newspapers (to give local people the option to purchase instead), and is generally limited to one parcel per purchaser. Overall, the process can take months to complete, if successful.

Benefits of Turks and Caicos

The benefits of Turks and Caicos over most other Caribbean countries can be summarized as follows:

- English-speaking

- U.S. Dollar

- No income/payroll tax

- No VAT/sales tax (although high customs duties and a 12% tourism tax exist)

- No restrictions on foreign land ownership

- No currency controls and capital restrictions

- Good flight connections (20 cities - 2023 data)

In addition, the Turks and Caicos has better infrastructure, a lower crime rate, and a more sustainable Government (a 2023 budget surplus instead of a deficit). Local communities are generally more socially cohesive compared with other Caribbean nations, which was evidenced during the aftermath of hurricanes Irma and Maria.

The GDP of the Turks and Caicos was estimated at $1.14 billion USD in 2022 (World Bank data).

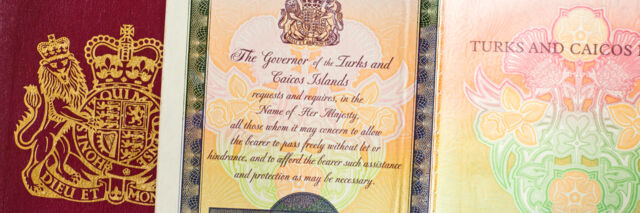

Through its status as a British Overseas Territory, TCI persons have right of abode in the United Kingdom and also qualify for Home rates at UK universities. This allows for more affordable education for those wishing to study in the UK.

Natural and Marine Environment

Apart from the quantitative factors above, one of the major reasons for foreign direct investment is the spectacular marine and natural environment. Providenciales is notably home to the world’s best beach: Grace Bay Beach.

Turks and Caicos, like the Bahamas, is a multi-island archipelago, and this results in extensive wetlands, mangroves, and reefs throughout the islands.

HDI and Minimum Wage

The Human Development Index (HDI) uses a number of factors, such as income, life expectancy, and education to rank a country on its overall development level. The HDI in Turks and Caicos is classed as Very High at 0.873.

Minimum wage is another interesting metric, as many Caribbean countries have extensive income and wealth inequality. In addition, the cost of living in the Caribbean is higher than in countries such as the United States. This is due to a variety of factors, but is primarily related to the fact that everything (food, fuel, etc.) has to be imported. Several countries in the Caribbean have a minimum wage that is impossible to survive on, and falls short of what anyone would consider a ‘living wage’. This inevitably leads to a massive dichotomy in the local societies, with many of the low-income workers living in unfit shacks and unable to have a decent life. The minimum wage in Turks and Caicos is $8 per hour.

Of the 20 Caribbean countries listed below, it’s worth noting the difference in HDI between British Overseas Territories (BOTs) and independent Caribbean countries. BOTs have an average HDI of .9294 (Very High), whereas independent nations are 0.742. In addition, the average BOTs minimum wage (where present) is $6.48, compared to an average minimum wage of $1.84 in the independent Caribbean countries.

Note: HDI in the table below is from 2018 UN data, except for the BOTs which use 2008 data, the last available date. Minimum wages are shown in U.S. Dollars, and conversions from local currencies, where required, used March 2019 exchange rates.

| HDI and Minimum Wages | |||

| Country | HDI | Status | Minimum Wage (USD) |

| Cayman Islands | .983 | British Overseas Territory | $7.20 |

| Bermuda | .981 | British Overseas Territory | - |

| British Virgin Islands | .945 | British Overseas Territory | $6.00 |

| U.S. Virgin Islands | .894 | U.S. Territory | $10.50 |

| Turks and Caicos | .873 | British Overseas Territory | $8.00 |

| Anguilla | .865 | British Overseas Territory | - |

| Montserrat | .821 | British Overseas Territory | - |

| The Bahamas | .807 | Independent | $6.50 |

| Barbados | .800 | Independent | $4.21 |

| Trinidad and Tobago | .784 | Independent | $2.58 |

| Antigua and Barbuda | .780 | Independent | $3.04 |

| St Kitts and Nevis | .778 | Independent | $3.33 |

| Cuba | .777 | Independent | $0.44 |

| Grenada | .772 | Independent | $1.67 |

| St Lucia | .747 | Independent | $0.46 |

| Dominican Republic | .736 | Independent | $1.14 |

| Jamaica | .732 | Independent | $0.56 |

| St Vincent | .723 | Independent | $1.16 |

| Dominica | .715 | Independent | $1.48 |

| Haiti | .498 | Independent | $0.41 |

International Flights

A frequently overlooked aspect when choosing where to invest is international flight connections. Notably, the Providenciales International Airport (PLS) has more international connections than any of the other British Overseas Territories, and overall in the Caribbean ranks at a respectable #7 out of 20 countries.

Data in the table below is for international flights (excludes domestic flights).

| International Flights | ||

| Country | Airport | # Connections |

| Dominican Republic | PUJ - Punta Cana | 48 cities |

| Cuba | HAV - Havana | 39 cities |

| Jamaica | MBJ - Montego Bay | 37 cities |

| The Bahamas | NAS - Nassau | 28 cities |

| Trinidad and Tobago | POS - Port of Spain | 24 cities |

| Antigua | ANU | 23 cities |

| Turks and Caicos | PLS - Providenciales | 20 cities |

| Barbados | BGI - Bridgetown | 21 cities |

| Cayman Islands | GCM - Grand Cayman | 20 cities |

| U.S. Virgin Islands | STT - St Thomas | 15 cities |

| Haiti | PAP - Port au Prince | 14 cities |

| St Kitts and Nevis | SKB - St Kitts | 10 cities |

| Grenada | GND | 8 cities |

| British Virgin Islands | EIS - Beef Island/Tortola | 7 cities |

| Bermuda | BDA - Hamilton | 7 cities |

| St Vincent and the Grenadines | SVD | 7 cities |

| Dominica | DOM | 7 cities |

| St Lucia | SLU | 6 cities |

| Anguilla | AXA | 3 cities |

| Montserrat | MNI | 1 city |